Here are four possible scenarios. Bitcoin can fail and become worthless. Or it can go big, much bigger than it already is, either by becoming the new world reserve currency, or a major payment system. And in either scenario, success or failure, you can either have a share of the cake, or watch it happening from the sideline.

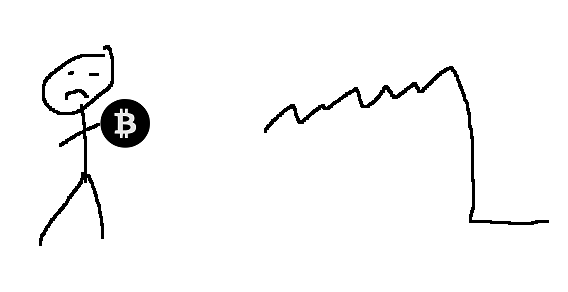

Scenario 1: You hold Bitcoin, and it goes to zero.

You were wrong, too bad. You lost this part of your investment allocation. Thanks to diversification it won’t ruin you. You won’t get left behind, others failed too.

Scenario 2: You don’t hold Bitcoin, and it goes to zero.

You were right, congratulations. You lost nothing.

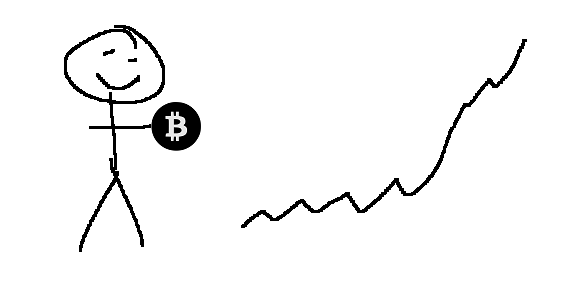

Scenario 3: You hold Bitcoin, and it goes to the moon.

You were right, congratulations. You won big, and got ahead of the game. You may have created generational wealth.

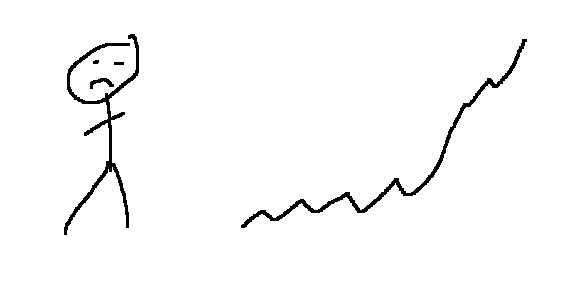

Scenario 4: You don’t hold Bitcoin, and it goes to the moon.

You were wrong, too bad. You missed what could be the biggest investment opportunity of your lifetime. People around you made it, while you and your offspring get left behind.

The key takeaway is that the consequences of the outcome of these scenarios are not on par, are asymmetric. If Bitcoin becomes worthless, it does not matter so much whether you invested or not, as long as you don’t put all eggs in one basket. But if Bitcoin goes big, then the difference between having and not having will be huge.

Wealth creation through financial investments is not much about being right or proving a point, but about making smart decisions. Even if you predict the downfall of Bitcoin, and you wish to see it in your lifetime, in order to brag about how right you were, it might not happen. If the paradigm shift happens, and crypto becomes the new money, then being a salty no-coiner would cost you and your offspring to get left behind.

Explanation of crypto terms:

“Going to zero” means becoming worthless, collapsing, failing.

“To the moon” means multiplying in value several times.

“Salty no-coiner” is someone who knows about crypto, but chooses not to buy or use it because he sees no future in it.

↝ Continue reading: How much do you need?