Comparing Bitcoin vs. other cryptocurrencies, called “altcoins”, such as Ethereum. Bitcoin was the first crypto currency, it launched in 2009. Since then thousands of other projects have started, and new ones appear on a daily basis.

Bitcoin is the top dog

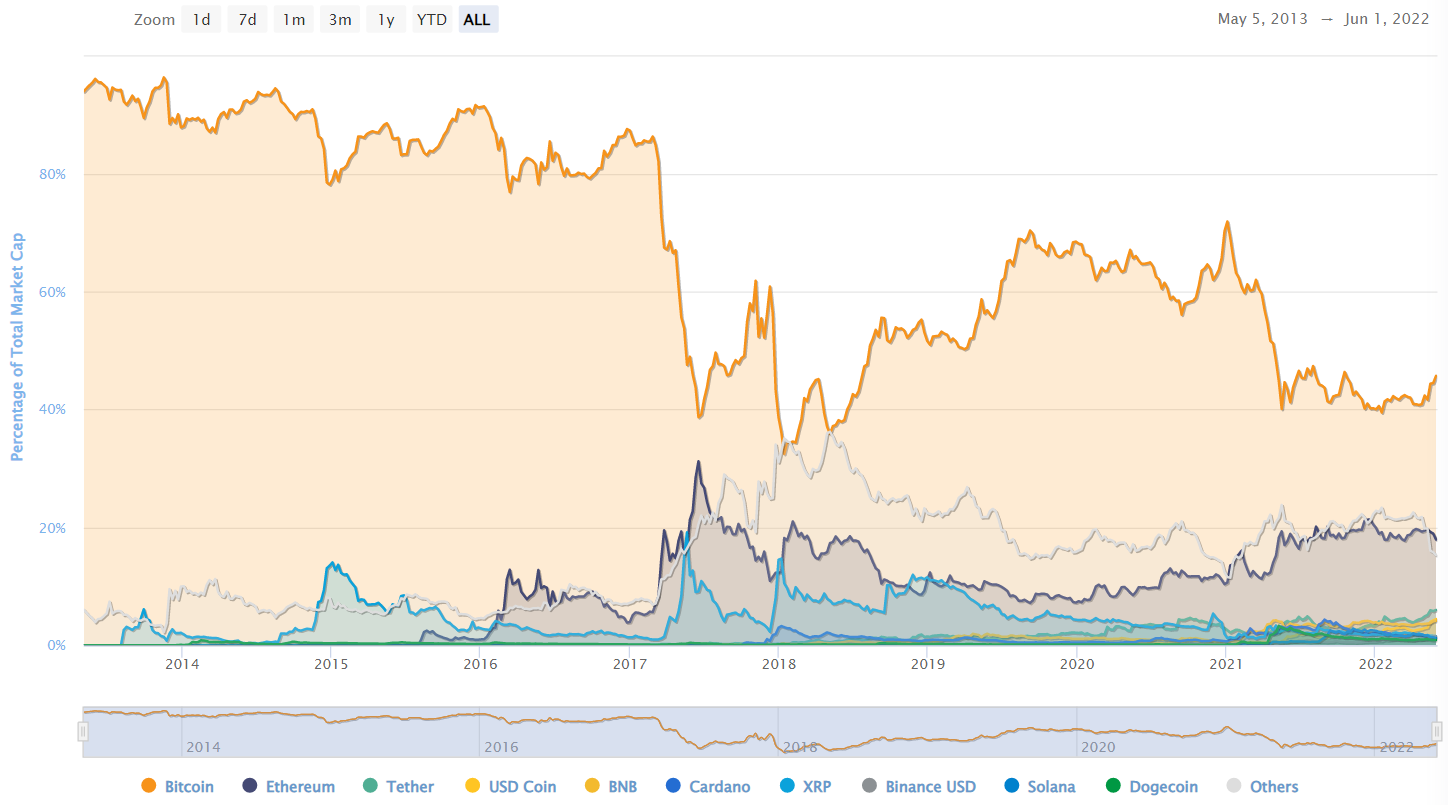

Bitcoin has remained the largest coin by market cap by far throughout its history. Ethereum is the second.

Altcoins are highly speculative

The message is: first get a bag of Bitcoin. Then, if you have appetite for more crypto, more risk, you need to dive deeper and learn. Beyond Bitcoin it’s the wild west. You are entering a completely new world, with dangers and opportunities on another level.

Newly started blockchain projects have huge price potential, and in the past, early investors made massive gains. 100x in a year (multiplying your money times one hundred) is not unheard of, a popular example is Solana in the year 2021.

Ethereum, the 2nd largest project by market cap, went from a high of 1400 USD per coin in January 2018 to a low of 84 USD in December 2018, temporarily losing 94% of its value in less than a year. In November 2021 it found a new high above USD 4800. That’s the moves we are talking about in altcoins, and that’s the 2nd largest coin.

Coupling with Bitcoin

Altcoins tend to move with Bitcoin. Moves are more dramatic, in both ways, up and down. There’s a thing called alt season, where after a price pump of Bitcoin and stabilization at new levels, the alternative coins pump. In crypto, going with the trend proved successful. Hop on the train when it goes up, hop off when the market moves down. Easier said than done. If you hop off, you always risk missing the next big move up.

Various use cases

Bitcoin acts as a store-of-value, with a peer-to-peer payment system in the making. There are other use cases for the blockchain technology: decentralized file storage, gaming, NFTs, and more.

Altcoins require time and knowledge

If you buy into crypto projects once they are presented on Coin Bureau, or get listed on popular mainstream exchanges such as Binance or Coinbase, or even worse get featured in mainstream media, you may end up being the exit liquidity. You buy the tokens when early investors already pocketed massive gains. The project may still have a lot of room to the upside, but could as well collapse.

The authors of this website urge people who are new to crypto to learn about the space before making meaningful investments in anything other than Bitcoin. Studying past performance of failed crypto projects helps. Terms such as hodl, exit liquidity, dex and cex, rug pull, alt season, shill, whale, fomo, fud, constant product market maker, ngmi, wagmi, moon, DeFi, DYOR, and bagholder should be understood.

Learn more:

“Coin Bureau” on YouTube has mostly neutral information about mainstream blockchain projects, and brings one video per day.

CoinMarketCap and CoinGecko list popular blockchain projects by market cap.

Crypto vocabulary:

A “bag” in crypto language refers to the coins one is holding as part of their portfolio.

For all the other terms, please DYOR (Do Your Own Research).