Comparing Bitcoin versus fiat currencies, such as the US Dollar. Fiat money is a government-issued currency that is not backed by a physical commodity, such as gold, but rather by the government that issued it.

Printing money

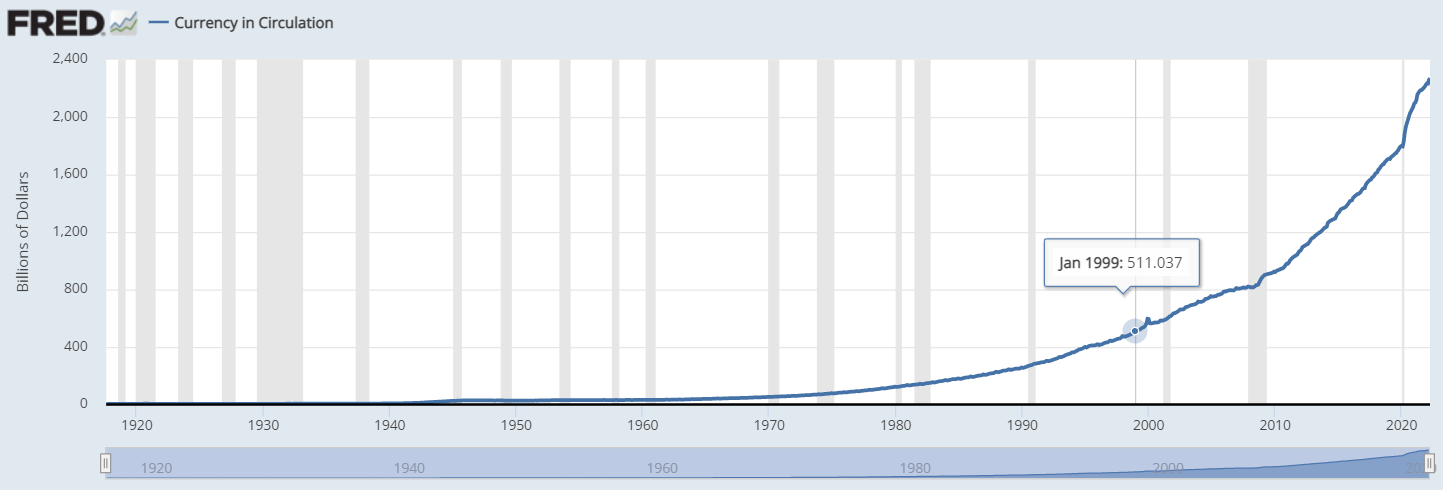

Fiat currencies are inflationary. More dollars are brought into existence over time.

There is a central organization in control over the supply, the US Federal Reserve, and it can “print” as many new dollars as it likes. The current holders of the money lose because their share of the total amount decreases.

The growth rate of all the dollars in circulation, known as the M2 Money Supply, soared a historic and shocking record 27% in the pandemic years 2020 to 2021.

Losing value

The US Dollar has lost most of its purchasing power in the last 100 years:

This chart does not show the pandemic years 2020/2021, where inflation got worse.

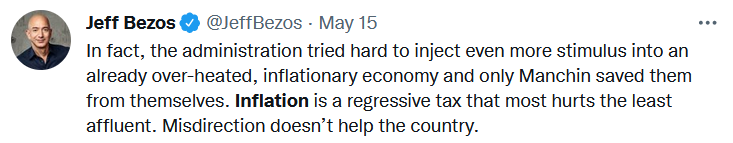

Jeff Bezos, the Amazon founder, wrote that Inflation is a tax that most hurts the poor:

Charlie Munger from Berkshire Hathaway said in January 2022: “I think the safe assumption for an investor is that over the next hundred years, the currency is going to zero”.

The current inflation rate in the USA is at a 40 year high, at an official rate of 8.5%. And it does not look any better in other parts of the world, Europe and elsewhere.

Countries with three-year cumulative inflation rates exceeding 100%:

- Argentina

- Iran

- Lebanon

- South Sudan

- Sudan

- Venezuela

- Zimbabwe

https://www.iasplus.com/en/news/2022/01/hyperinflationary-economies

There have been dozens of cases in recent history where a country’s currency has collapsed through hyper inflation, including Germany, Brazil, Russia, Mexico. https://en.wikipedia.org/wiki/Hyperinflation

Alternatives

With such high inflation, people are looking for an alternative as store-of-value, and some find Bitcoin.

Bitcoin won big

While the US Dollar (and all the other fiat currencies) have lost in purchasing power in the last decade, Bitcoin has massively gained. The first purchase using Bitcoin was in the year 2010, it was two pizzas for 10,000 (ten thousand) Bitcoins. In May 2022, two pizzas (valued at USD 40) would cost just 0.00136 Bitcoin.

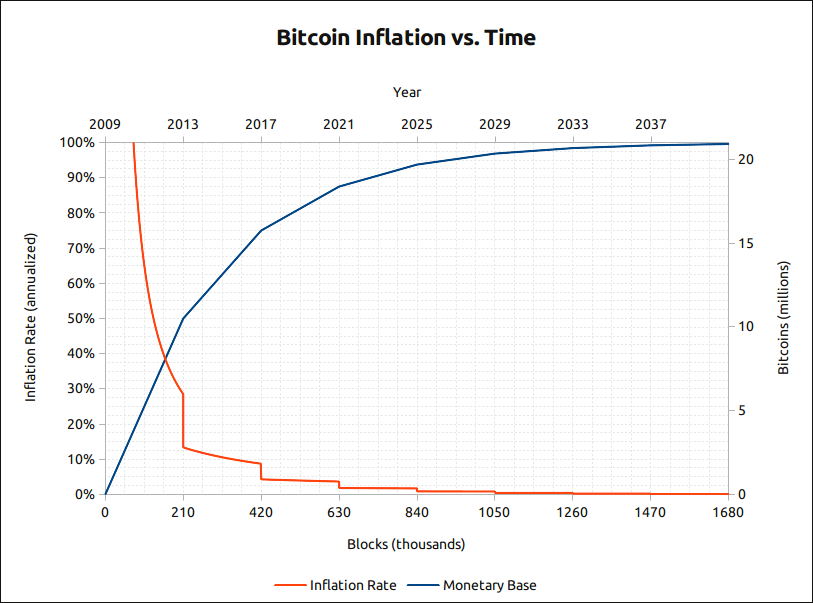

Bitcoin will be deflationary, the opposite of having inflation.

When the Bitcoin blockchain launched in the year 2009, it started out with zero coins. By running a software on computers, people could “mine” and receive coins. The amount of coins created in this way decreases over time, and will halt at 21 million coins, predicted to be in the year 2140. This is the fixed, hard-coded max supply. No one, no central entity, no person, no group, can print additional coins. Until spring 2022 already 90% (19 million) of all coins have been mined.

The Bitcoin price has risen in price during this time of inflation (of more coins brought into existence) because the inflation was offset by massive demand for the coins.

↝ Continue reading: Bitcoin vs. Stocks