Real estate as investment and as a place to live has generally performed well in recent decades, it kept its value in terms of purchasing power, and it beat inflation. A house is a house no matter the value of the country’s fiat currency.

At present, having mortgage on real estate at an interest rate below the inflation rate also means gaining additional value. The money that has to be paid back for the credit in the future will be worth less, and easier to gain.

Owning a primary home is generally financially better than renting, with lower monthly costs and with the long-term benefiting from rising prices. This is, unless the property is bought at the height of a real estate bubble.

When comparing the performance of Bitcoin to the one of real estate in the last decade or even the last 5 years, the difference does not even fit on a chart. 😉

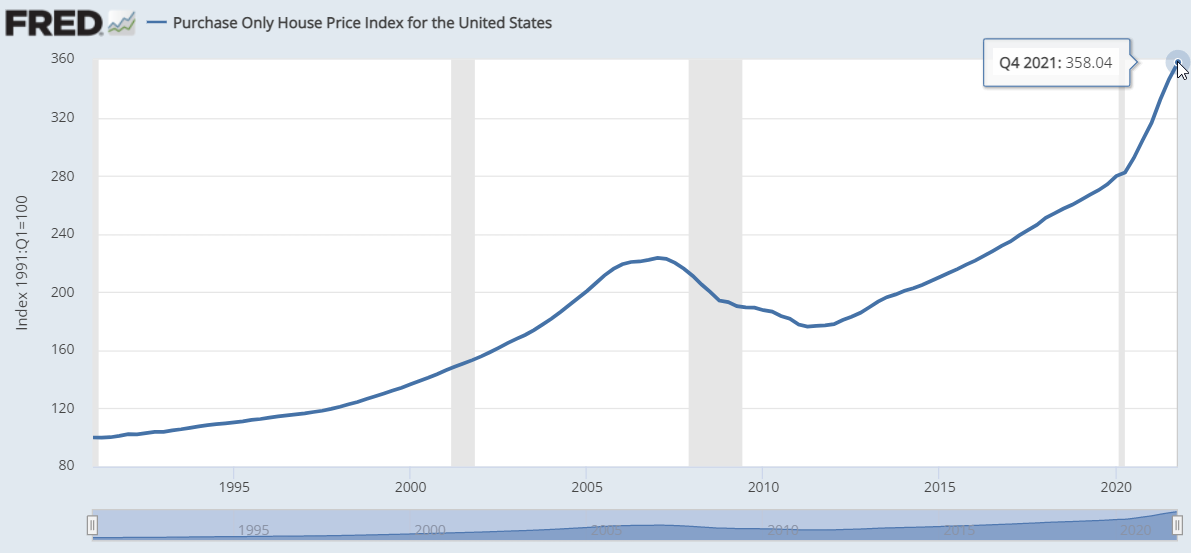

Housing bubble?

2008 was a housing bubble. Look where we were in Q4 2021. And now interest rates should rise to fight inflation.

Chinese real estate bubble

China offers limited possibilities for investment to its people. The stock market bubble and crash of 2007/2008 left its marks. Bitcoin was popular, both for mining and as investment, but crypto was banned in 2021. The real estate sector is where most of the money goes into.

The sector has plenty of problems. Families own two or three homes while not needing nor renting them, just as investment. Land is not owned but leased for 70 years, and actually less from the time the buildings are finished. The build quality is low. Experts warn about a looming real estate crisis, which can easily spread to other countries and the world.

Taxes

It’s easy for the government to tax a house. If the owner doesn’t like the new law, he can’t move elsewhere and take the house with him. He can sell it, and on that transaction can be another tax, and the new buyer will take all the taxes into consideration when making his offer.

It’s hard for a country to tax Bitcoin that remains in self custody.

Countries have amassed unsustainable amounts of debt, and intensified this during the pandemic years. Inflation helps to kill debt, at the expense of the poor. As governments need to find new sources of income, real estate is an easy find.

Limited potential

House prices can only go as high as what people can afford to pay. When salaries go up, people can pay more. But salaries (minus inflation) did not increase in the past decades in developed countries. Mortgages become more affordable as the interest rates they charge go lower. At lower rates, people can take a higher burden, therefore pay more to buy a house. But the mortgage rates have reached historical lows, and can’t go any lower. However, they can go higher, and that could trigger a chain reaction, and bring house prices lower.

Like most stocks have to justify their valuation by the profits of the company, or at least their outlook, most real estate has to justify their price by the rent income it can generate. A few beach front exclusives are exempt from this because a rich person just wants to have it.

Bitcoin does not have to justify its price.

Illiquid

Real estate is the least liquid asset compared here. If you need cash, then you can either sell it or possibly take a mortgage on it, both take weeks to months until you get to cash. And if the market is down, you may have to take a loss, or wait years.

While Bitcoin is highly liquid and you can trade it to cash at any time 24/7/365, the exchanges never sleep, the 2nd part is true also for Bitcoin. With its high volatility, if the asset is in a bear market, you either take a big loss (compared to the high) or wait up to years.

Work for it

Investing in stocks is work-free. Investing in Bitcoin is work-free. Investing in a rental property is not. Either you pay someone and reduce your profit and still have work, or you handle tasks yourself. In many cases it’s an active income, not a passive income.

Diversification

Most people don’t have the money to diversify their real estate investment. They have enough to buy one property, in one location.

Population collapse

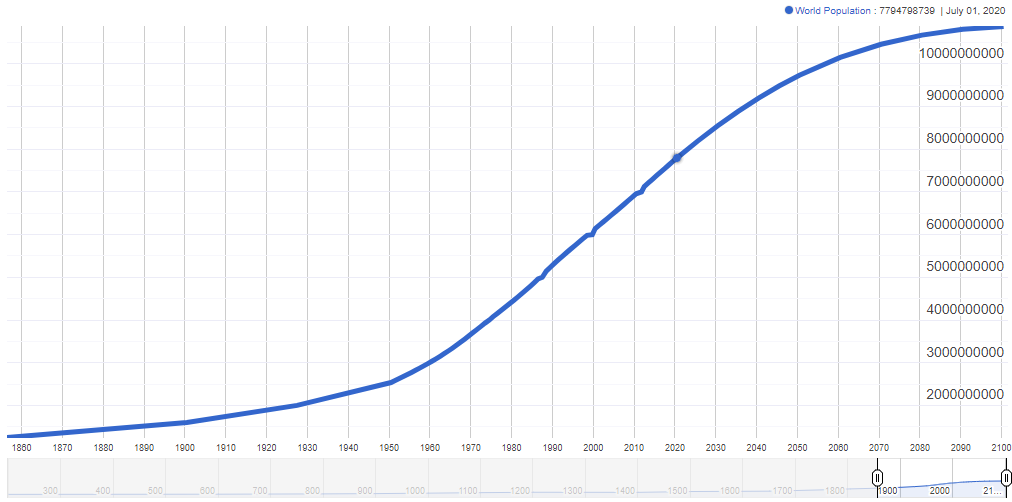

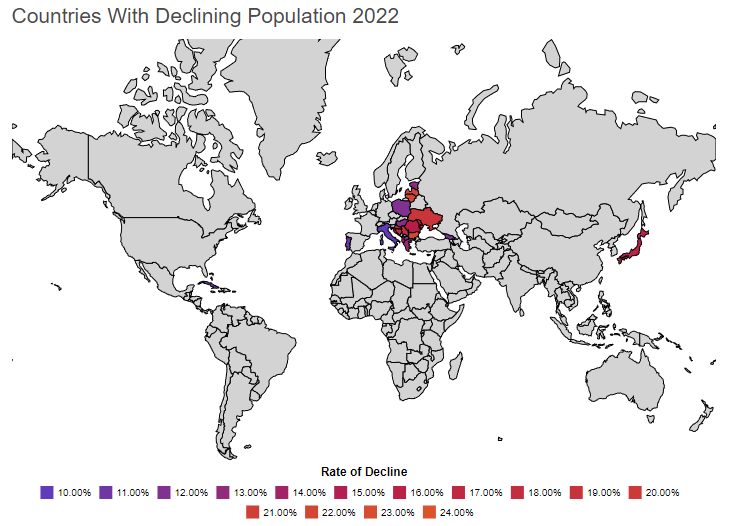

More population means more demand for real estate. This has been a driving force behind the real estate boom in the world in the 20th century. More construction was done in the 20th century than in all centuries before combined. But the global growth in humans comes to a halt, and multiple developed countries are shrinking already, including Japan, Venezuela and Italy.

Living space per person

The amount of living space occupied per person was growing in the past. Homes became more luxurious. But there comes a size where people just don’t need more, at least until we have autonomous robots performing the cleaning and maintenance.

Fewer people sharing the same apartment or house also increased demand for homes, with many single-person households. This number already decreased much, and it can’t go below 1.

As couples have less children or none, they also require less living space. Who needs a house with garden alone, a small city apartment often is the preferred choice.

Secondary homes and holiday homes are a thing. But they also require maintenance, bring additional expenses and no income, and are a less flexible lifestyle compared to hotels and AirBnb on demand. There’s a limit to this driver of additional housing too.

Location, location, location

This was the slogan for the last decades. We’ve seen decades of urbanization, people leaving the country side and moving into or near cities. While in rural areas schools close, villages die and houses literally fall apart, new districts near fancy cities are booming. Their real estate prices have performed best.

But the pandemic years brought changes, and some changes are here to stay. At first the lockdowns generated demand for country-side houses. Then the transition to work-from-home – which is here to stay – does not require living near expensive city centers anymore.

The future will bring autonomous transportation door to door, and package and food deliveries by drone.

Once you leave the downtown area of a city and expand the radius, the available land to settle increases squared. More sellers, less buyers. Lower prices.

Robots in construction

While manufacturing has benefited greatly from technology and automation, house construction in 2022 is still mostly manual labor, and therefore expensive. And while building new is expensive, older houses that are technically inferior, with outdated layout plans, retain value.

The future will bring construction robots that will eventually bring down the manual labor part of the total construction cost. We will see how older constructions will retain value when this happens.

Wars

Wars demolish buildings. One would think that we are past the time of wars, but look to Ukraine. No insurance pays for destroyed buildings.

After world war II, Germany issued an additional mortgage on houses based on their estimated value to help fund the state.

↝ Continue reading: Bitcoin vs. Collectible items