Looking into popular myths and fud surrounding Bitcoin, and countering fairy tales with facts and arguments.

Excessive power consumption

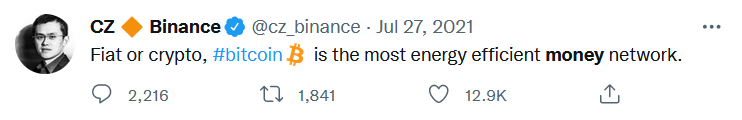

It is true that the current proof-of-work consensus mechanism uses “a lot” of electricity.

The first questions are: is this consumption justified?

In fact, it is a tiny fraction of the energy used to run the current banking system, with all of its offices and employees.

The Bitcoin network uses less energy than the tumble clothes dryers in the world.

The next questions are, can the consumption be reduced, and/or can it be replaced by green energy?

A switch to the newer proof-of-stake mechanism, as Ethereum will do it, would reduce the power consumption by 99%. This is currently not planned, and experts believe it will never happen with Bitcoin.

Renewable energy could produce enough for the whole world’s needs of electricity in the future, the current bottleneck is energy storage. And nuclear fusion power may be possible in the future, solving all energy requirements on earth.

Money laundering and criminal use

The probably most pervasive myth about Bitcoin is that it is mostly used for illicit activity.

Chainalysis: Transactions involving illicit addresses represented just 0.15% of cryptocurrency transaction volume in 2021.

https://blog.chainalysis.com/reports/2022-crypto-crime-report-introduction/

United Nations: estimated money laundered globally in one year is 2-5% of global GDP, or $800B to $2 trillion in USD.

As past cases have shown, it is impossible to cash out large amounts of stolen funds through crypto. One good example is the 2016 Bitfinex hack, where the couple behind it has been able to cash out only small amounts in 5 years, and finally got caught and arrested because of this.

All transactions on the Bitcoin blockchain are public, with sender and receiver address and amount, and this history remains public forever.

Bitcoin has no real use

Bitcoin allows making payments to anyone in the world around the clock, without the need of a bank. Bitcoin is inclusive, giving access to finance to the unbanked, people who do not qualify to open a bank account. About 5.4% in the USA and 1.7 billion people or 20% world wide. The Lightning Network will make these payments instant (fast) and cheap (free).

Bitcoin has become increasingly popular as an inflation resistant store-of-value, much like gold, giving it the nickname “digital gold”. In countries with super high inflation rates, it is of real use to its inhabitants to quickly convert to something that keeps its purchasing power.

Read also

Coinbase has a detailed article with sources about these and more myths: https://www.coinbase.com/learn/crypto-basics/7-biggest-bitcoin-myths

↝ Continue reading: How to Buy