Although no one can predict the exact future, research has been done with what-if scenarios, and calculations how such scenarios could affect the price of Bitcoin. Since Bitcoin is not a stock, does not produce anything, it does not have to justify its price in comparison to earnings. Instead it’s simply supply and demand that make the price. So then, what are the known potential future catalysts?

Bitcoin as peer-to-peer cash system

The original idea of the creator of Bitoin, Satoshi Nakamoto, was to create a “A Peer-to-Peer Electronic Cash System”. Today, Bitcoin is mostly used as a store-of-value only, but the lightning network would like to bring change. This “layer 2” technology, which is sitting on top of the Bitcoin blockchain, allows instant and relatively cheap money transfers.

The strike.me company aims to bring the payment system to 400,000 physical shops including Walmart and McDonald’s, by integrating with the Point-of-Sale system. Integration with the largest online shopping software Shopify is also on its way. The shops can choose to receive Bitcoin, or have the payment converted to USD.

The country of El Salvador is already using this system since 2021.

The credit card payment system was an invention that helped the capitalist world. But it’s an archaic system created in 1949, costs the shops roughly 3% of their sales price, and it’s about time to replace it with something modern and cheap.

Bitcoin forks and other altcoins attempted to take on the role of peer to peer electronic cash system, such as Litecoin and Bitcoin Cash, none has succeeded. Kaspa is a much newer tech stack based on years of mathematical research, and may be the first to leapfrog the others and achieve Satoshi’s vision.

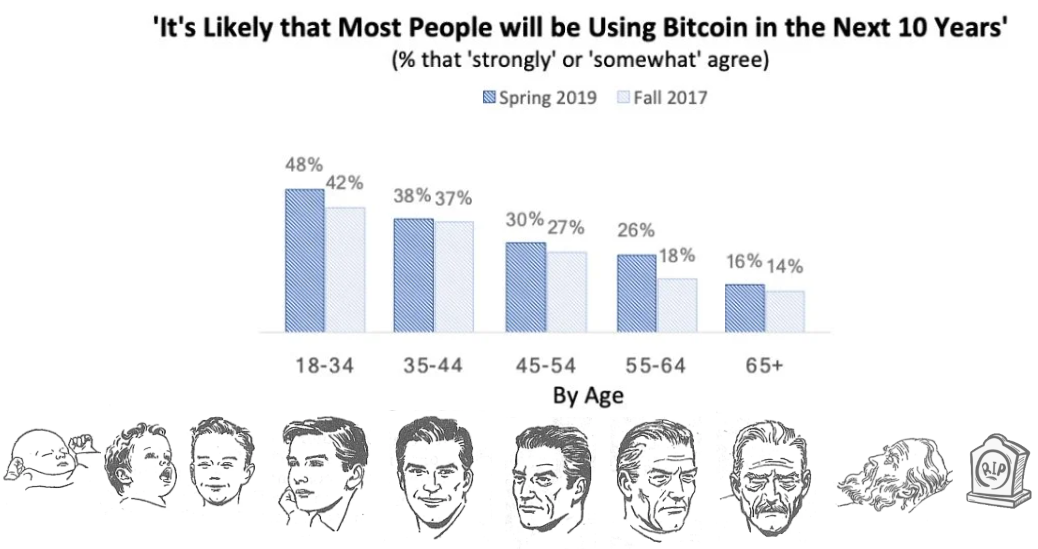

Generations move up

Interest, trust and hope in Bitcoin is rising over time, and is directly proportional to age. This is the common picture: new ideas and technologies first get adopted by the young, then later spread to other generations and corporations.

The generations that created wealth by saving are diminishing, because of old age. Saving back then meant creating wealth. Saving now means losing money.

Wealth flows from older people (who did not invest into coins), to younger people by inheritance, and younger people want more crypto. Generations move up, and larger parts of the world population want crypto, and a larger percentage of their assets go into it.

Warren Buffet (age 91) and Charlie Munger (age 98), widely regarded as the best investors of the 20th century, are speaking up against crypto. They made great wealth by investing in monopoly companies, and tobacco companies (but that’s not the topic of this website). Fact is, these voices still help to suppress the price of Bitcoin because people listen to them, and these voices will disappear soon.

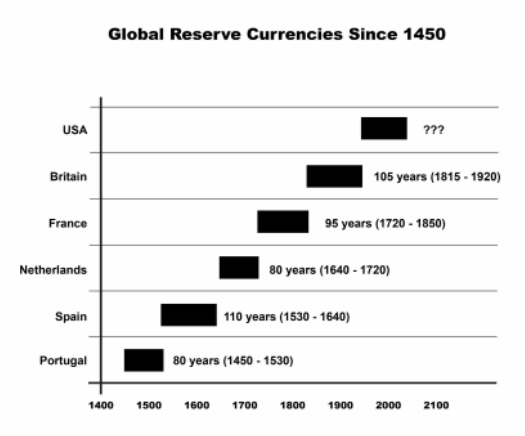

Bitcoin as world reserve currency

A reserve currency is foreign money that is held in significant quantities by central banks and other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy.

Since the year 1921 the world’s primary reserve currency was the US Dollar. The dominance of the USD has declined from 71% in the year 2000 to 59% in the year 2021.

The recent steep increase of the money supply (printing dollars) has damaged the US Dollar. But other nation’s currencies are not a good alternative either.

National banks around the world have increased their holdings of gold, shifting from USD to gold, to a record high in 31 years.

Before the United States Dollar took over its dominant role in 1921, other nations held that position:

The life span of a currency as world reserve currency is about 100 years. The USD now stands at 101… and while the Dollar is losing influence, there is no alternative fiat currency on the rise. Not the European Euro, not the Chinese Yuan, not the Japanese Yen, not the British Pound, not the Russian Ruble, not the Indian Rupie.

It is not impossible, and some analysts believe it’s likely, that national banks will start adding Bitcoin to their balance sheets. This would send a signal through the markets, and would be a massive price pump.

Legal tender in more countries

Thus far Bitcoin has been adopted as official payment currency (“legal tender”) in two small countries:

- El Salvador (SV) in September 2021

- Central African Republic (CF) in April 2022

In May 2022, El Salvador’s president Nayib Bukele held an event about the adoption of Bitcoin, financial inclusion and the digital economy. Representatives from 44 countries traveled to El Salvador, including those from 32 central banks. Attending countries included Paraguay, Haiti, Honduras, Costa Rica and Ecuador in Latin America; Angola, Ghana, Namibia and Uganda in Africa; and Bangladesh, Palestine and Pakistan in Asia.

The US Dollar is used in many parts of the world as a relatively stable currency. However, the rapidly increasing money supply is hurting these countries, and naturally they are looking for alternatives.

Adoption by more countries gives Bitcoin positive news, trust, and more demand.

Bitcoin as part of every portfolio

There are ~8 billion humans in the world, and the Bitcoin market cap is $556 billion USD (May 2022). This comes to $69.5 per human invested in Bitcoin. Not much.

An estimated 106 million people worldwide own a bit of Bitcoin, that is 1.325% of the world population. Fewer than 1 million people are estimated to own 1 full Bitcoin or more.

Investment advisors started recommending to add crypto currency, namely Bitcoin, to a diversified investment portfolio, with ranges from 1% to 5% of a person’s net worth in Bitcoin. As a high-risk high-reward option, and inflation hedge.

Survey: 80% of institutional investors expect digital assets to replace traditional investments

https://finance.yahoo.com/video/crypto-80-institutional-investors-expect-161409251.html

A growing number of Bitcoins are in the hands of die-hard hodlers, people who do not sell their coins no matter what. And so the amount of available supply is limited. If large demand comes in, the new buyers may have to fight over a small number of coins, and this can send the price to the moon.

The launch of Bitcoin ETFs in the USA is a huge step into this direction, making it much easier for investors to hold exposure to Bitcoin without the risk of managing private keys or the hassle and risks of opening and managing crypto exchange accounts.

Regulatory support

Bitcoin investor Michael Saylor anticipates more crypto regulations, saying that this will bolster Bitcoin’s dominance in the crypto space, remove competition from shitcoins, and bring legal clarity and investment certainty to institutional investors (the big money).

Institutional money

Institutions are still mostly sitting on the sidelines when it comes to crypto investing. Are they allowed to buy crypto at all, where to buy, who has custody of the coins. In case of doubt, it may be better for employees to wait instead of risking to break regulations or the law.

Banks and investment corporations are increasingly looking to hire crypto experts.

https://decrypt.co/60838/crypto-fund-grayscale-is-hiring-specialists-for-an-etf

https://www.linkedin.com/news/story/banks-go-big-on-crypto-talent-5164868/

When Tesla added Bitcoin to its balance sheet, its share price increased, signaling consent from shareholders. When MicroStrategy announced the intent to invest into Bitcoin, the majority of its shareholders agreed by keeping the stock. The only other publicly traded company holding Bitcoin is Block (formerly Square), a digital payments company. There is a lot of room for growth here.

The big money is not with private retail investors, but with large hedge funds, pension funds, etc, and once some of these start allocating money, the Bitcoin price can pump to new highs quickly.

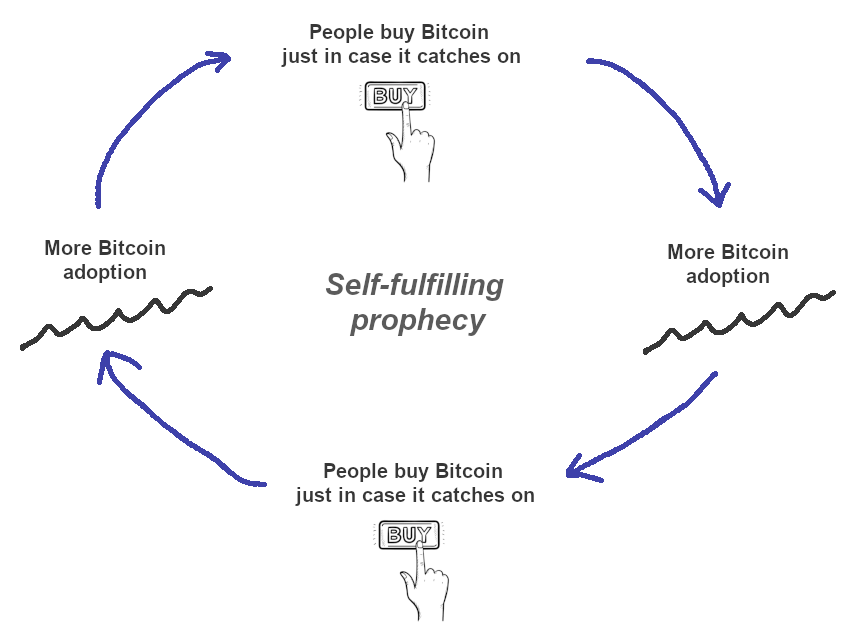

Self fulfilling prophecy

People buy Bitcoin to not be left behind, therefore more people buy. But this is not limited to private individuals. The same works with companies, investment funds, and finally with countries.

It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.

Satoshi Nakamoto, Bitcoin creator, 2009

The next financial crash

According to some financial experts, the next crisis is right around the corner.

The money printer of the US federal reserve went bonkers during the pandemic years. China has powered parts of its growth of GDP with construction, now it has a real estate problem. Sri Lanka just defaulted on its debt. People around the world suffer from high inflation. Interest rates should go up to fight inflation, but that would bring those into troubles who heavily borrowed money: house owners with mortgages, zombie companies, nations.

With every big change there are losers and winners. Bitcoin could be the big winner.

The 2008 financial crisis brought the creation of Bitcoin. The next one may bring the mass adoption of crypto.

1-bitcoin-per-child.com

Is it too late to buy Bitcoin?

It depends. Bitcoin has had an impressive ascend since its inception in 2009, where it started as an experiment at no initial value. If you think that Bitcoin will soon disappear, and its value go to zero, then it’s too late. If you see the potential for Bitcoin in the long term, then we are still early.

Resources

Market cap of gold: https://companiesmarketcap.com/gold/marketcap/

Market cap of Bitcoin: https://coinmarketcap.com/currencies/bitcoin/

How many people own Bitcoin? https://www.buybitcoinworldwide.com/how-many-bitcoin-users/

↝ Continue reading: Looming risks