The young generation is proportionally more invested in crypto assets than the older generations, both in terms of how many people of each age group possess crypto assets, and in how much percentage of their wealth is in crypto. Why is this, and what does it mean?

From young early adopters, to corporations, to the rest

Blockchain and cryptographic money are a technology, and a rather new invention. The younger generations have always been faster at adopting new technologies, whether computers, the internet, mobile phones or smart phones, social networks. The adoption always came bottom up, from the younger, then to corporations, then to the older. This is certainly one big factor.

Wealth through saving is over

Another factor is how wealth is built. The young generation today simply needs to take shortcuts. Let me explain.

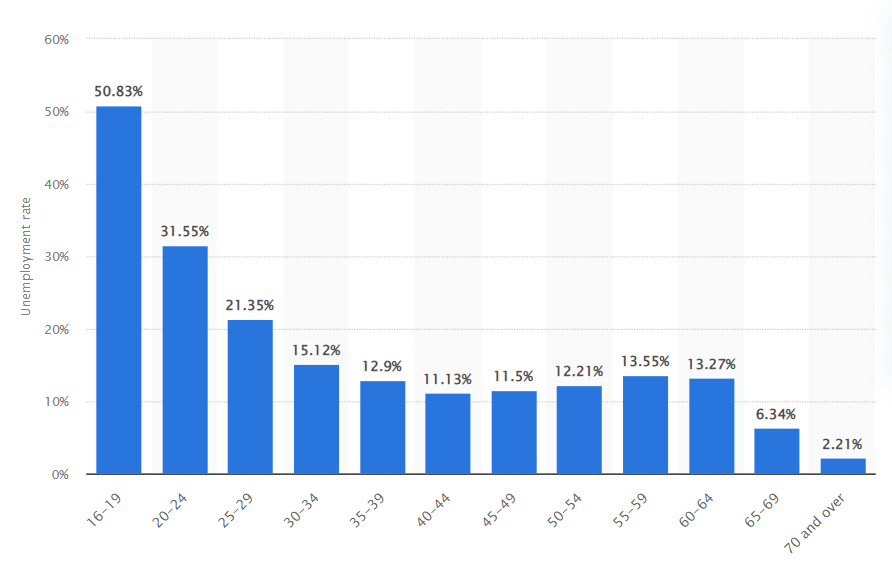

Spain, a rich 1st world country, has 40% unemployed among the young under 25 years old. And those that have a job work under worse financial conditions compared to people close to pensioner age, earning less than half. It is common for the young to live with their parents past their 30th birthday.

Unemployment rate in Spain in 2021, by age group:

In many countries buying your own home has become unaffordable for large parts of the population, especially those with less income and assets, and that means the younger. Instead of being able to buy an apartment, they pay more for rent than what a mortgage would cost – and they cannot benefit from the increasing real estate prices and accumulate wealth. They have not reached high incomes [yet], have not inherited [yet], have had no time to grow assets.

The boomer generation grew into a time of high demand for labor, of growing salaries and opportunities. Saving money from the monthly income was possible and worth it, high interest rates well above the inflation rate made it possible to build a small fortune until retirement. There was a clear path.

Today, saving money means losing money. The option of saving money to build wealth is gone. Interest rates are at or below zero, and inflation is high. Salaries after inflation have not increased in the western world for large parts of the population in decades. Sure, people can afford to buy more products mass produced by machines, but the purchasing power for real assets that gain or retain value has diminished massively.

Life habits have changed, and many have traveling on the wish list before saving for a house – a dream that seems too far anyway. The deferred life concept of the boomer generation, work and save until retirement, is not en vogue and won’t find right swipes on Tinder.

The promise of crypto

We’ve witnessed the phenomenons of meme stocks, then meme coins. Bitcoin and other crypto assets seem to offer a shortcut to build financial wealth. With low initial capital, making big returns, in a few short years.

Parts of the young generation will get to wealth through inheritance. The boomers had to build their own wealth, inheritance was small, and split among more siblings. Birth rates are shrinking. In many cases 4 grandparents will leave their inheritance to 1 or 2 grandchildren. What will the grandchildren do with all the real estate? Rent it out and live from the monthly income, and deal with the problems of the tenants? Some will, others rather sell and take the money. Big money. Where will that money go, to protect it from inflation, or grow? Right. Some will find its way into Bitcoin.

↝ Continue reading: Bitcoin versus other assets